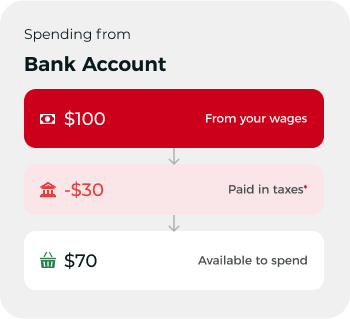

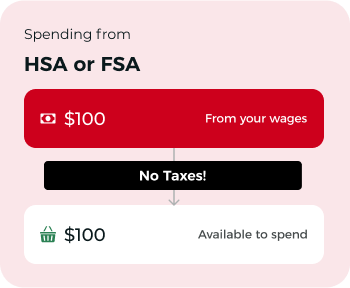

How Does Using My HSA/FSA Save Me Money?

HSA/FSA accounts were created so individuals could use pre-tax money to pay for expenses used to treat, mitigate, or prevent a diagnosed medical condition.

Because HSA/FSAs use pre-tax money, you’re getting more purchasing power for your dollars. Rather than pay taxes on income and then spend it on health items, qualified customers can use pre-tax funds to invest in root cause interventions.

Elegible Products

FAQs

Q: What are HSA and FSA accounts?

A: Health Savings Accounts (HSA) and Fiexilble Spending Acounts (FSA) are tax-advantaged accounts that let you use pre-tax dollars to pay for eigible health and wellness expenses.

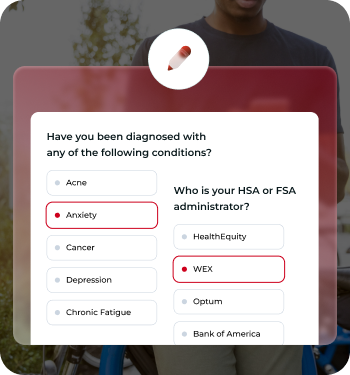

Q: Who qualifies to use HSA/FSA funds through TrueMed?

A: If your health goal qualifies-such as improving strength, mobility, or managing a chronic condition-vou may be eligible to use vour HSA/FSA funds with the help of TrueMed. Eligibility is determined through a short medical intake form.

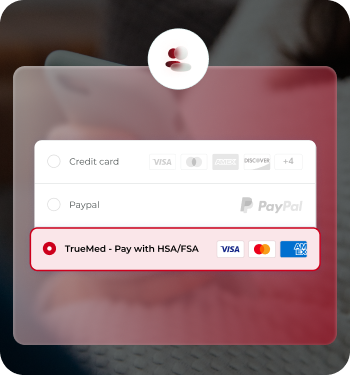

Q: What is TrueMed?

A: TrueMed is our partner that helps you determine if RitFit products quallify as a medically necessary expense, so you can use your HSA/FSA dollars to make your purchase.

Q: What is a letter of medical necessity, and why is it required?

A: This letter confirms that your purchase meets your health needs. It helps approve your claim and ensures compliance with the process.

Q: I don't have enough in my HSA/FSA to cover the full amount-can I still se TrueMed?

A: Yes! You can still apply for approval and use a different payment method tlete the purchase. Once approved, you may be able to reimburse part of youchase using your available HSA/FSA funds.

Q: How long does it take to receive HSA or FSA reimbursement?

A: Reimbursement timing depends on your HSA/FSA provider, but many process claims within 1-2 weeks. Check with your provider for specific timelines.